Websol Energy share price target 2025 : Websol Energy Systems Ltd, a key player in India’s solar photovoltaic sector, has recently seen a spike in investor interest. With the rising global shift towards renewable energy and India’s strong push for sustainable infrastructure, Websol is gaining traction. In this detailed article, we will analyze the Websol Energy share price target 2025 and provide insights for the years 2026, 2027, 2028, 2029, and 2030. We will look at the company’s fundamentals, financial data, market trends, and long-term prospects to help investors make informed decisions.

Websol Energy Systems Ltd: Company Overview

Founded in Kolkata, Websol Energy Systems Ltd is a manufacturer of photovoltaic monocrystalline solar cells and modules. It caters to the growing demand for renewable power generation equipment across India and abroad. The company provides modules for both commercial and industrial solar projects.

With India targeting net-zero emissions and increased dependence on solar energy, Websol is strategically positioned to benefit. Despite facing challenges in past years, recent market sentiment and sector tailwinds have reignited interest in the stock.

Websol Energy Share Price 2025 Today (as of May 2025)

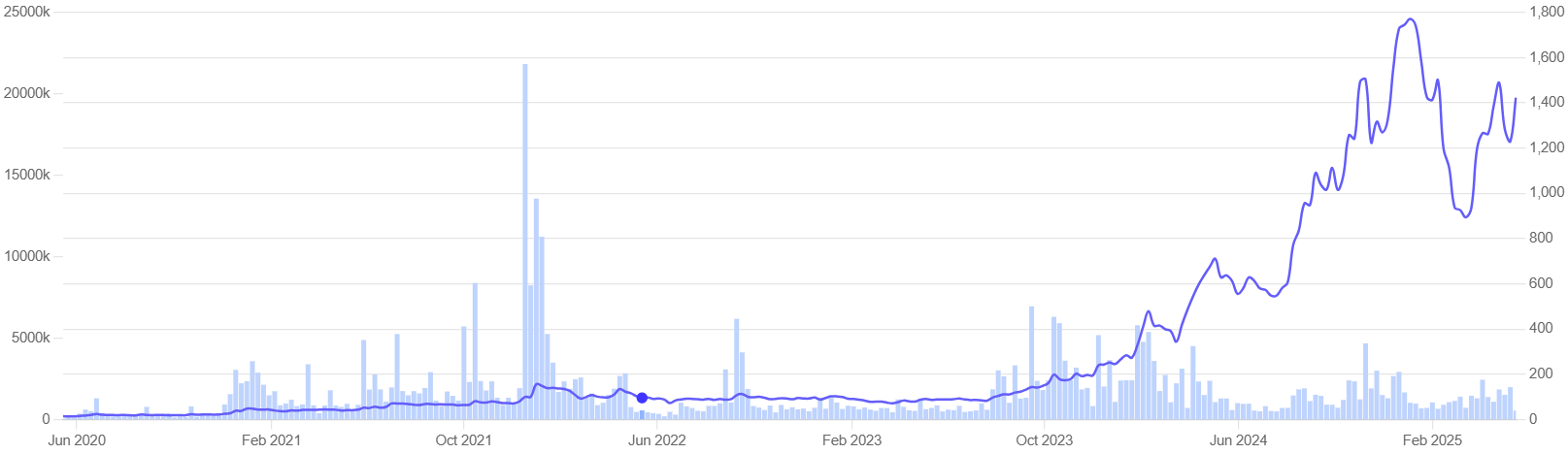

As of May 14, 2025, the share price of Websol Energy is ₹1,423.30, up by 4.99% in a single day. The stock has shown bullish movement recently due to positive industry news and market sentiment.

- Market Cap: ₹6,189 crore

- Stock P/E: 125

- ROE (Return on Equity): -6.40%

- Sales Growth (5 years): -17.7%

Despite its high valuation and weak past profitability, the company’s strong industry tailwinds and future expectations are driving the price up.

Financial Snapshot and Analysis

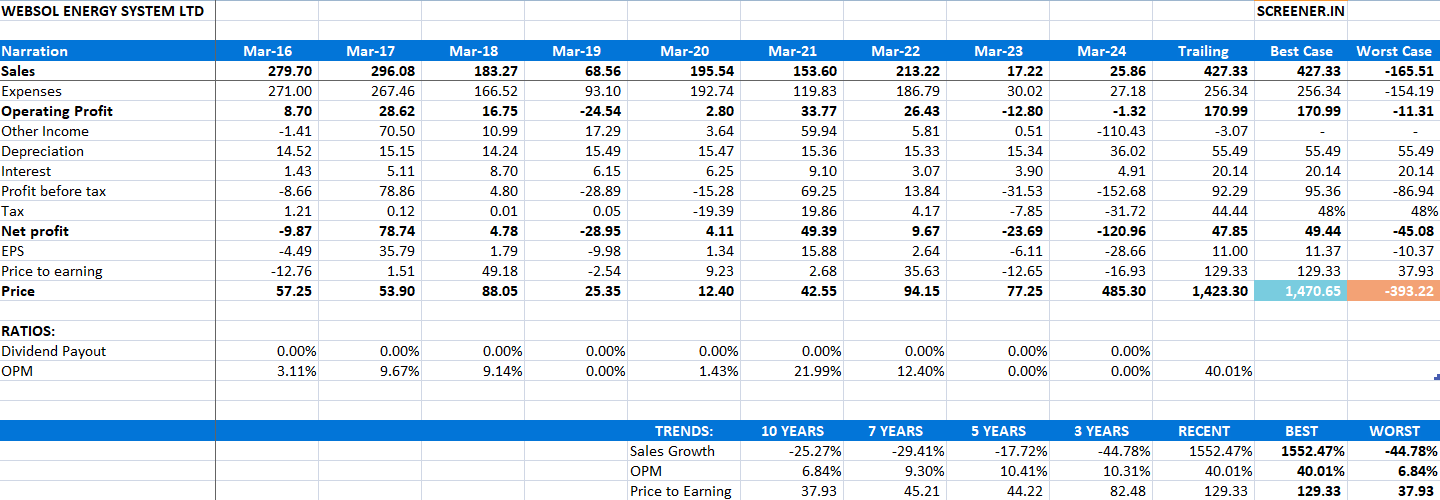

Websol Energy Share Price Target 2025 has shown a mixed financial performance. Here’s a closer look at some key metrics:

- Revenue Trends: The company reported weak revenue growth in the past few years, but demand for solar modules is expected to rise significantly.

- Profitability: Net profits have been inconsistent, with occasional losses due to high competition and input costs.

- Debt Level: Websol’s debt levels are manageable, but high promoter pledge (~91.8%) could be a concern.

Still, the stock has caught investor attention due to the long-term prospects of solar energy.

Websol Energy Profit & Loss 2025

Share Price & Valuation (P/E Ratio)

-

Price has moved from ₹57.25 (FY16) to ₹485.30 (FY24), despite poor FY24 numbers.

-

Price to Earning (P/E) ratio in FY24 is negative due to losses, but previously high in FY23 (82.48) and FY21 (2.68).

✅ Takeaway:

-

Share price has risen disproportionately to earnings.

-

The P/E ratio is distorted, making it risky for new entries unless future earnings improve.

| Trend | 10 Years | 5 Years | Recent (1Y) |

|---|---|---|---|

| Sales Growth | -25.27% | -17.72% | 1552.47% |

| OPM | 6.48% | 6.31% | 5.26% |

| Price to Earnings | 37.93 | 45.21 | 129.33 |

Websol Energy Balance Sheet 2025

📊 Balance Sheet Overview of Websol Energy Systems Ltd

| Particulars | Mar’18 | Mar’19 | Mar’20 | Mar’21 | Mar’22 | Mar’23 | Mar’24 |

|---|---|---|---|---|---|---|---|

| Equity Share Capital | 26.68 | 29.03 | 30.59 | 31.14 | 36.64 | 38.80 | 42.21 |

| Reserves | 73.94 | 94.84 | 93.78 | 142.78 | 154.95 | 152.48 | 65.51 |

| Borrowings | 80.70 | 75.97 | 77.68 | 35.21 | 36.47 | 27.51 | 183.62 |

| Other Liabilities | 187.42 | 151.87 | 108.67 | 75.09 | 57.84 | 48.28 | 61.41 |

| Total Liabilities | 368.74 | 351.71 | 310.72 | 284.22 | 285.90 | 267.07 | 352.75 |

Shareholding Pattern

As of March 2025:

- Promoters: 27.71% (with ~91.8% of shares pledged)

- Retail and Others: 72.29%

While the high promoter pledge could raise red flags, the consistent holding indicates confidence in the company’s future.

Websol Energy Share Price Target 2025

Based on current fundamentals, sector growth, and technical forecasts from sources like WalletInvestor:

- Target Price Range: ₹1,600 to ₹1,750 by end of 2025

Reasons:

- Strong market optimism for renewable energy

- Growing demand for solar modules

- Stock already showing momentum in 2025

Websol Energy Share Price Target 2026

If Websol successfully capitalizes on increasing demand and improves its margins, the stock could continue its upward trend.

- Expected Target: ₹1,850 to ₹2,050

Catalysts:

- Potential government solar tenders

- Entry into international markets

- Reduced promoter pledge and better profit margins

Websol Energy Share Price Target 2027

By 2027, assuming consistent revenue and margin improvements, Websol could see further valuation expansion.

- Target Price: ₹2,200 to ₹2,400

Growth Drivers:

- Large-scale solar project execution

- Strategic collaborations or partnerships

- Technology upgrades in solar panel manufacturing

Websol Energy Share Price Target 2028

If Websol enters into long-term power purchase agreements (PPAs) and strengthens its recurring revenue, the share price may continue climbing.

- Forecast Range: ₹2,500 to ₹2,700

Positive Factors:

- Shift towards green energy by industries

- Cost-efficient production driving better EBITDA margins

- Higher institutional interest in ESG stocks

Websol Energy Share Price Target 2029

Assuming the company has now reached stability in revenue and profitability, investor confidence could increase further.

- Target Estimate: ₹2,800 to ₹3,000

Supportive Trends:

- Consistent dividend payouts (if profitability improves)

- Strong order book and timely execution

- Increasing exports of solar panels

Websol Energy Share Price Target 2030

If Websol becomes a leader in solar tech innovation and partners with key stakeholders in the energy ecosystem, the stock could cross the ₹3,200 mark.

- Estimated Range: ₹3,100 to ₹3,300

Long-term Catalysts:

- Global expansion in solar markets

- Domestic demand from EV and energy storage sectors

- Achieving net-zero goals by government and corporates

SWOT Analysis of Websol Energy

Strengths:

- First-mover advantage in solar manufacturing

- Growing domestic demand for solar modules

- Government policy support for renewable energy

Weaknesses:

- High P/E ratio

- Inconsistent profitability

- High promoter pledged shares

Opportunities:

- Export potential in Europe and Southeast Asia

- Increased rooftop solar installations

- Strategic partnerships with energy companies

Threats:

- Competition from Adani Solar, Waaree, Vikram Solar

- Volatility in raw material prices

- Policy and regulatory risks

Should You Invest in Websol Energy?

The Websol Energy share price target 2025 to 2030 shows steady growth potential. While the company faces operational challenges, the market environment is favorable. If Websol improves its execution and financial discipline, it could turn into a multibagger in the long term.

Investment Tip: Only invest after evaluating risks and returns. Diversification is key. Consult a SEBI-registered financial advisor before making investment decisions.

Conclusion

Websol Energy is in the right sector at the right time. Despite short-term volatility, the long-term story remains intact. If you are a long-term investor looking to ride the renewable energy wave, this stock is worth tracking closely.

🔍 FAQs About Websol Energy Share Price Target 2025

Q1. What is the Websol Energy share price target for 2025?

A: Based on current financials and market trends, the Websol Energy share price target for 2025 is estimated to be between ₹1,600 to ₹1,750, assuming consistent growth in solar sector demand and improved profitability.

Q2. Is Websol Energy a good stock to buy for the long term?

A: Websol Energy has potential in the renewable energy sector, but recent financial data shows fluctuating performance. Long-term investors should evaluate fundamentals like debt levels, net profits, and ROE before investing.

Q3. What are the key financial indicators of Websol Energy in 2024?

A: In FY 2024, Websol Energy reported a net loss of ₹120.96 crore, with negative ROE (-112%) and ROCE (-58%). However, its revenue improved to ₹25.86 crore, and the solar industry outlook remains positive.

Q4. Why did Websol Energy stock fall in 2023?

A: The decline in Websol Energy’s stock in 2023 was primarily due to high losses, weak operating margins, and negative investor sentiment. A ₹23.69 crore loss impacted the stock price significantly.

Q5. What is the future outlook of Websol Energy shares by 2030?

A: If Websol Energy can reduce debt, improve margins, and capitalize on the growing demand for solar technology, the share price could reach ₹250–₹300 by 2030. However, this depends on consistent execution and sector performance.

Q6. Is Websol Energy a multibagger stock?

A: Currently, Websol Energy does not show multibagger characteristics due to volatile earnings and negative returns. It may become a strong stock if it improves its financials and benefits from India’s solar growth story.

Q7. Does Websol Energy pay dividends?

A: No, Websol Energy has not paid any dividends in the last several years. The company is currently focusing on reinvestment and operational stabilization.

Q8. What sector does Websol Energy operate in?

A: Websol Energy operates in the renewable energy sector, primarily focused on manufacturing solar photovoltaic (PV) cells and modules.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any stock or financial instrument. The views and analysis expressed are based on publicly available data and market trends as of the time of writing. Stock markets are subject to high risks and volatility, and past performance is not indicative of future results. Readers are advised to conduct their own research and consult with a certified financial advisor before making any investment decisions. The author and the website do not assume any liability for financial losses incurred based on the content of this article.

Read More:

- Virtual Galaxy Share Price Target 2025 to 2030: Will It Be the Next Multibagger IT Stock?

- Ather Energy Share Price Target 2025, 2026, 2027, 2028, 2029, 2030: Full Forecast & Growth Outlook

Virtual Galaxy Share Price Target 2025 to 2030: Will It Be the Next Multibagger IT Stock?