Virtual Galaxy Share Price Target 2025: Virtual Galaxy Infotech Ltd is making waves in the Indian stock market after its successful IPO in May 2025. As the company sets a strong foundation in the IT services and SaaS-based software development space, investors are eagerly searching for insights about the Virtual Galaxy share price target 2025 and beyond. In this detailed article, we analyze the company’s fundamentals, financials, and future prospects to estimate potential share price targets for the years 2025, 2026, 2027, 2028, 2029, and 2030.

Company Overview: What is Virtual Galaxy Infotech?

Founded in September 1997 and based in Nagpur, Maharashtra, Virtual Galaxy Infotech Ltd is a leading IT services provider focusing on SaaS-based solutions, core banking software, enterprise resource planning (ERP), and e-governance projects. The company serves several key sectors, including BFSI (Banking, Financial Services, and Insurance).

Virtual Galaxy Infotech provides end-to-end software services, right from product development and deployment to after-sales support. Their flagship offerings include core banking software, ERP implementation, and customized software services.

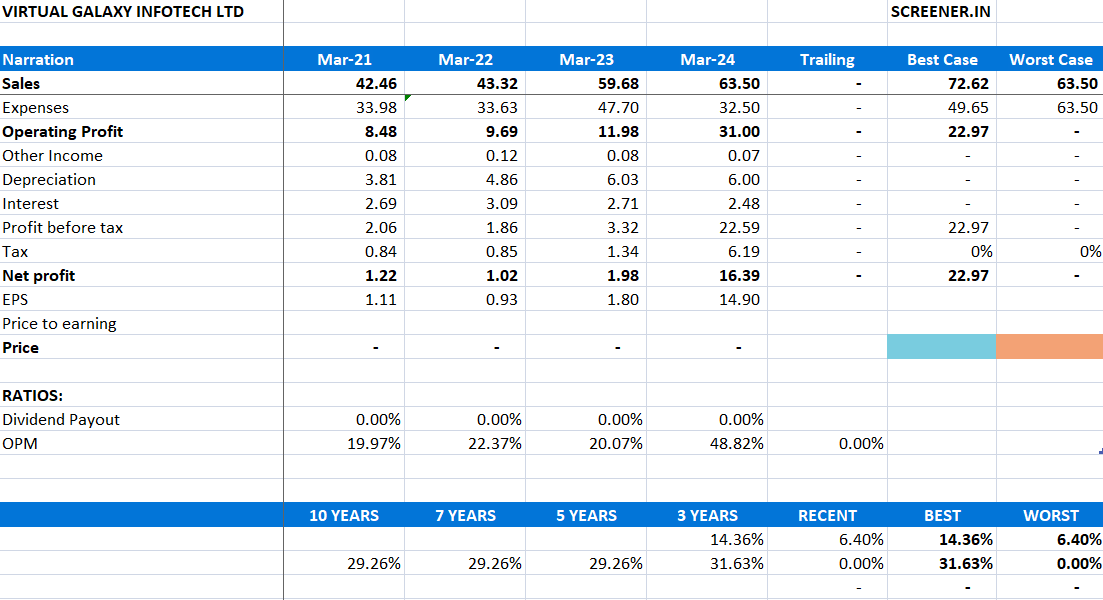

Virtual Galaxy Profit & Loss 2025

| Metric | Mar-21 | Mar-22 | Mar-23 | Mar-24 | Best Case | Worst Case |

| Sales (₹ Cr) | 42.46 | 43.32 | 59.68 | 63.5 | 72.62 | 63.5 |

| Expenses (₹ Cr) | 33.98 | 33.63 | 47.7 | 32.5 | 49.65 | 63.5 |

| Operating Profit | 8.48 | 9.69 | 11.98 | 31 | 22.97 | 0 |

| Net Profit | 1.22 | 1.02 | 1.98 | 16.39 | 22.97 | 0 |

| EPS (₹) | 1.11 | 0.93 | 1.8 | 14.9 | – | – |

Observation:

-

Sales have steadily grown from ₹42.46 Cr in 2021 to ₹63.5 Cr in 2024.

-

Operating Profit and Net Profit jumped significantly in FY2024 — a sign of strong operational efficiency and cost control.

-

In 2024, Net Profit reached ₹16.39 Cr, indicating substantial improvement (almost 8× compared to 2023).

-

EPS rose sharply to ₹14.90 in FY24 from ₹1.80 in FY23, showing higher returns per share.

Source: Screener

Period CAGR (%) 10 Years 29.26% 7 Years 29.26% 5 Years 29.26% 3 Years 14.36% Recent 6.40% Best 14.36% Worst 6.40%

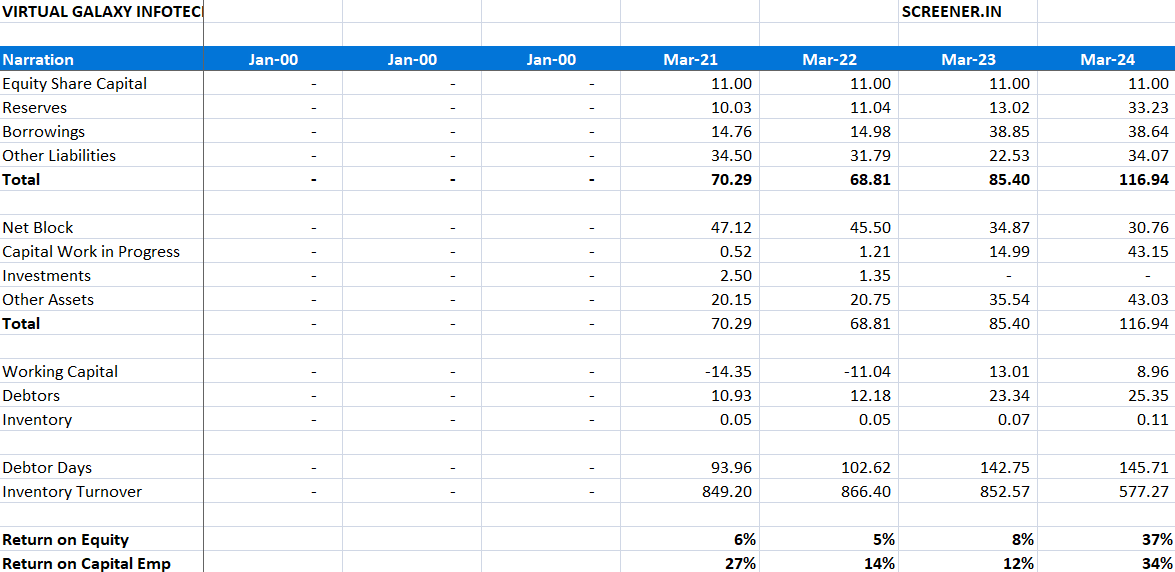

Virtual Galaxy Balance Sheet 2025

🧾 1. Liabilities Side (How the company is funded)

| Item | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|

| Equity Share Capital | ₹11.00 Cr | ₹11.00 Cr | ₹11.00 Cr | ₹11.00 Cr |

| Reserves | ₹10.03 Cr | ₹11.04 Cr | ₹13.02 Cr | ₹33.23 Cr |

| Borrowings | ₹14.76 Cr | ₹14.98 Cr | ₹38.85 Cr | ₹38.64 Cr |

| Other Liabilities | ₹34.50 Cr | ₹31.79 Cr | ₹22.53 Cr | ₹34.07 Cr |

| Total Liabilities | ₹70.29 Cr | ₹68.81 Cr | ₹85.40 Cr | ₹116.94 Cr |

Key Insights:

-

Reserves more than doubled in FY24, from ₹13.02 Cr to ₹33.23 Cr — indicating strong retained earnings.

-

Borrowings increased drastically in FY23 but remained stable in FY24.

-

Total capital employed increased by ~66% from ₹70.29 Cr in FY21 to ₹116.94 Cr in FY24

2. Assets Side (Where the money is used)

| Item | Mar-21 | Mar-22 | Mar-23 | Mar-24 |

|---|---|---|---|---|

| Net Block (Fixed Assets) | ₹47.12 Cr | ₹45.50 Cr | ₹34.87 Cr | ₹30.76 Cr |

| Capital Work in Progress | ₹0.52 Cr | ₹1.21 Cr | ₹1.94 Cr | ₹43.15 Cr |

| Investments | ₹2.50 Cr | ₹1.35 Cr | – | – |

| Other Assets | ₹20.15 Cr | ₹20.75 Cr | ₹35.54 Cr | ₹43.03 Cr |

| Total Assets | ₹70.29 Cr | ₹68.81 Cr | ₹85.40 Cr | ₹116.94 Cr |

🟢 Key Insights:

-

Huge jump in Capital Work in Progress (CWIP) to ₹43.15 Cr in FY24 — indicates ongoing expansion or capex project.

-

Net Block (existing fixed assets) is declining, meaning assets are either aging or being replaced.

-

Other assets (possibly receivables, cash, etc.) are growing steadily.

IPO Highlights and Investor Response

Virtual Galaxy Infotech recently launched its IPO from May 9 to May 14, 2025, with a price band of ₹135 to ₹142 per share. The issue was solely a fresh issue of 65.70 lakh shares, aiming to raise ₹93.29 crore.

- Anchor Investment: ₹26.1 crore was raised via 15 institutional investors.

- Grey Market Premium (GMP): Trading at a premium of ₹75–₹80, indicating over 50% premium on the upper band.

- Oversubscription: The IPO was subscribed more than 42 times, a sign of strong market confidence.

This successful IPO and investor enthusiasm are strong indicators of a promising future for Virtual Galaxy’s stock.

Financial Performance: Strong Fundamentals

Investors looking for the Virtual Galaxy share price target 2025 and beyond must first understand its financial strength:

- Revenue: Increased to ₹63.58 crore in FY24 from ₹59.76 crore in FY23.

- Profit After Tax (PAT): Jumped from ₹0.72 crore in FY23 to ₹16.54 crore in FY24.

- Return on Equity (ROE): 53.52%

- Return on Capital Employed (ROCE): 31.68%

Such robust numbers point to a company that is not only growing rapidly but also generating high returns on capital.

Virtual Galaxy Share Price Target 2025

Based on its IPO GMP, strong financials, and market sentiment, the Virtual Galaxy share price target for 2025 is expected to range between ₹200 and ₹220. This would reflect the initial listing gain plus further appreciation due to growth in revenues and earnings.

Key drivers for 2025 share price:

- Strong post-IPO demand

- Momentum from grey market premium

- Projected increase in revenue post-IPO investments

Virtual Galaxy Share Price Target 2026

If the company continues its growth trajectory and executes its expansion plans effectively, the Virtual Galaxy share price target for 2026 could be in the range of ₹240 to ₹260.

Contributing factors:

- Expansion of development centers

- Increased software product sales

- Entry into new domestic or international markets

Virtual Galaxy Share Price Target 2025-2027

Looking further ahead, Virtual Galaxy could potentially trade between ₹270 to ₹290 in 2027 if it sustains earnings growth of 20–25% CAGR.

Supporting reasons:

- High retention of BFSI clients

- New government contracts or e-governance projects

- Improvements in technological infrastructure

Virtual Galaxy Share Price Target 2028

By 2028, assuming the company introduces new SaaS solutions and leverages AI and cloud computing trends, the share price may reach ₹300 to ₹320.

Possible growth drivers:

- Rise in demand for IT automation and banking tech

- Global expansion or mergers

- Strong free cash flow generation

Virtual Galaxy Share Price Target 2029

By 2029, if Virtual Galaxy diversifies its portfolio and enhances recurring revenue streams, the stock could potentially touch ₹330 to ₹360.

Key indicators:

- Successful product diversification

- Entry into international fintech markets

- Strengthened partnerships and collaborations

Virtual Galaxy Share Price Target 2030

If Virtual Galaxy maintains its profitability, innovates with next-gen technologies, and captures larger market share, the Virtual Galaxy share price target for 2030 could be in the range of ₹375 to ₹400.

Major catalysts:

- Advanced product launches

- Acquisition-led growth

- Continued investor trust and institutional buying

SWOT Analysis of Virtual Galaxy Infotech

Strengths:

- Established IT player with diversified services

- High ROE and ROCE

- Strong IPO response

Weaknesses:

- Limited international presence

- Heavy reliance on the BFSI sector

Opportunities:

- Growing demand for SaaS and ERP in India

- Expansion to untapped sectors and geographies

Threats:

- Competition from larger IT firms

- Regulatory and data security concerns

Should You Invest in Virtual Galaxy?

Virtual Galaxy Infotech shows potential for being a strong mid-cap IT player. Given its rapid earnings growth, SaaS expertise, and high investor confidence, the company has the right ingredients to become a multibagger over the long term.

Important Advice: Always consult a financial advisor before investing. Stock market investments are subject to market risks.

Conclusion

The Virtual Galaxy share price target 2025 to 2030 shows a consistent growth path backed by strong fundamentals and promising future strategies. Investors seeking high-growth IT stocks may consider keeping an eye on Virtual Galaxy Infotech Ltd for long-term returns.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any stock or financial instrument. The views and analysis expressed are based on publicly available data and market trends as of the time of writing. Stock markets are subject to high risks and volatility, and past performance is not indicative of future results. Readers are advised to conduct their own research and consult with a certified financial advisor before making any investment decisions. The author and the website do not assume any liability for financial losses incurred based on the content of this article.

Read More: Ather Energy Share Price Target 2025

Ather Energy Share Price Target 2025, 2026, 2027, 2028, 2029, 2030: Full Forecast & Growth Outlook