Hyundai Motors Share Price Target 2025: If you’re an investor or planning to enter the automobile sector in the stock market, understanding the Hyundai Motors share price target 2025 and beyond is essential. Hyundai Motors, one of the largest automakers globally, has been making remarkable strides, especially in the electric vehicle (EV) segment. In this article, we’ll provide a deep year-wise analysis along with long-term projections, SWOT analysis, and profit & loss insights.

Hyundai Motor Company – Company Overview

Hyundai Motor Company (HMC), headquartered in Seoul, South Korea, is one of the world’s leading automobile manufacturers. Founded in 1967, Hyundai has grown into a global automotive powerhouse with operations in over 200 countries and a strong presence in passenger vehicles, SUVs, and commercial vehicles.

Hyundai Motors share price target 2025 – Hyundai owns Kia Motors and Genesis Motors, forming the Hyundai Motor Group, the third-largest vehicle manufacturer in the world by production volume. The company is at the forefront of innovation in the electric vehicle (EV) and hydrogen fuel cell vehicle (FCEV) space.

Current Market Overview

-

Current Price: ₹1,878 (as of May 2025)

-

Market Cap: ₹1,52,632 Cr.

-

52 Week High / Low: ₹1,970 / ₹1,542

-

P/E Ratio: 27.8

-

Book Value: ₹194

-

ROCE (Return on Capital Employed): 54.2%

-

ROE (Return on Equity): 42.2%

-

Dividend Yield: 0.00%

-

Face Value: ₹10

Hyundai Motors share price target 2025 – With a consistent uptrend, Hyundai Motor India Ltd’s stock has made a strong comeback from its March 2025 lows (~₹1,560) to touch near its all-time high levels. High return ratios indicate that the company is effectively using capital to generate strong profits.

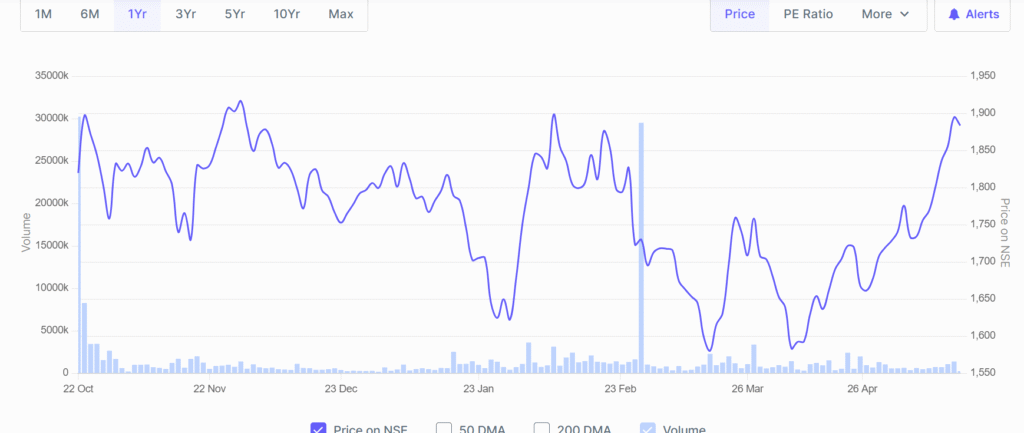

Price Trend Analysis – Last 1 Year

Over the past 12 months, the stock has shown high volatility but overall positive momentum. After a dip in February and March 2025, the price has surged steadily and is currently trading near ₹1,878.

This sharp recovery indicates strong investor confidence, especially after Q4 FY2024 and Q1 FY2025 results exceeded market expectations.

Quarterly Performance Snapshot

| Quarter | Sales (₹ Cr) | Net Profit (₹ Cr) | OPM (%) | EPS (₹) |

|---|---|---|---|---|

| Sep 2023 | 18,409 | 1,602 | 13% | – |

| Dec 2023 | 16,590 | 1,393 | 13% | – |

| Mar 2024 | 17,132 | 1,649 | 14% | – |

| Jun 2024 | 16,974 | 1,448 | 14% | 17.82 |

| Sep 2024 | 16,876 | 1,338 | 13% | 16.46 |

| Dec 2024 | 16,242 | 1,124 | 11% | 13.83 |

| Mar 2025 | 17,562 | 1,583 | 14% | 19.48 |

Despite minor revenue dips, Hyundai has maintained healthy operating margins, and Q4 FY25 showed a strong profit rebound. This indicates operational efficiency and demand stability.

Hyundai Motors Share Balance Sheet

|

|

Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 | Mar-24 | Mar-25 |

| Equity Capital | 813 | 813 | 813 | 813 | 813 | 813 | 813 |

| Reserves | 12,938 | 12,467 | 14,318 | 15,823 | 18,965 | 9,472 | 14,954 |

| Borrowings + | 1,069 | 1,098 | 1,354 | 1,175 | 1,188 | 832 | 847 |

| Other Liabilities + | 8,258 | 7,953 | 10,014 | 10,274 | 13,193 | 14,537 | 12,757 |

| Total Liabilities | 23,078 | 22,331 | 26,498 | 28,084 | 34,159 | 25,654 | 29,372 |

| Fixed Assets + | 4,930 | 6,958 | 7,205 | 6,559 | 6,052 | 7,519 | 7,004 |

| CWIP | 1,208 | 562 | 796 | 529 | 1,332 | 639 | 4,704 |

| Investments | 139 | 137 | 137 | 141 | 147 | 147 | 147 |

| Other Assets + | 16,802 | 14,675 | 18,360 | 20,854 | 26,627 | 17,349 | 17,517 |

| Total Assets | 23,078 | 22,331 | 26,498 | 28,084 | 34,159 | 25,654 | 29,372 |

Annual Financials (FY19–FY25)

-

Revenue Growth: ₹43,258 Cr (FY19) → ₹67,654 Cr (FY25)

-

Net Profit Growth: ₹2,582 Cr → ₹5,492 Cr

-

Operating Margin: Improved from 11% to 13%

-

EPS (FY25): ₹67.59

-

Dividend Payout: Dropped to 31% in FY25, signaling more retained earnings for growth

The company has shown consistent earnings growth with high profitability, despite challenges such as inflation, chip shortages, and global economic pressures.

Peer Comparison

| Company | CMP (₹) | P/E | ROCE (%) | Market Cap (₹ Cr) |

|---|---|---|---|---|

| Hyundai | 1,878 | 27.83 | 54.22 | 1,52,631 |

| Maruti Suzuki | 12,630 | 27.37 | 21.76 | 3,97,090 |

| Mahindra & Mahindra | 3,069 | 29.49 | 14.07 | 3,81,719 |

| Mercury EV-Tech | 63.08 | 181.54 | 2.96 | 1,198 |

| Hindustan Motors | 26.17 | 16.86 | 2.32 | 546 |

Despite having a much lower market cap than Maruti or M&M, Hyundai beats both in ROCE, showing highly efficient capital use. Also, the P/E ratio is at par, indicating fair valuation.

Share Price Targets

Hyundai Motors Share Price Target 2025

-

Short Term (End of 2025): ₹2,000 – ₹2,200

-

Justification: Strong Q4 earnings, ROCE of 54.2%, and EPS growth suggest a bullish momentum.

Hyundai Motor India Ltd Share Price Target 2026

-

Range: ₹2,300 – ₹2,600

-

The company is expected to launch new EV models and expand rural market penetration. These factors may support higher valuations.

Hyundai Motor India Ltd Share Price Target 2027

-

Range: ₹2,800 – ₹3,100

-

As EV adoption grows in India, Hyundai’s upcoming Ioniq and other electric offerings could boost sales and market share.

Hyundai Motor India Ltd Share Price Target 2030

-

Range: ₹4,000 – ₹4,800

-

Over the long term, Hyundai is expected to benefit from the government’s FAME scheme, hydrogen and hybrid technology advancements, and a rising export footprint from India.

Hyundai Motor India Ltd Share Price Target 2040

-

Range: ₹10,000 – ₹12,000

-

In the long term, the automobile sector will be a growing sector, and Hyundai Motors can be the leading company in the world.

Fundamental Strengths

-

✅ High ROCE & ROE: Indicates profitability and efficient management

-

✅ Consistent EPS Growth: ₹67+ in FY25

-

✅ Low Debt: Borrowings stand at just ₹847 Cr in FY25

-

✅ Strong Global Brand: Hyundai enjoys high trust and product recall in India

-

✅ Operational Efficiency: Net profit grew despite a minor sales decline

Risks to Watch

-

❗ Zero dividend yield may disappoint long-term income investors

-

❗ Competition from Tata Motors and Maruti in the EV and SUV segments

-

❗ Global uncertainties like chip shortages, regulatory shifts, and oil prices

Should You Invest in Hyundai Motor India Ltd?

If you’re looking for a fundamentally strong auto stock with steady profits, innovation pipeline, and strong market standing, Hyundai could be a great mid to long-term pick. While short-term volatility is present, the stock’s fundamentals remain rock-solid.

Investors with a long-term view and risk appetite may consider accumulating on dips, especially if the stock retraces near ₹1,700–₹1,750.

SWOT Analysis of Hyundai Motors

Strengths:

- Global brand with trusted reputation

- Strong EV research and innovation

- Diversified product portfolio

Weaknesses:

- High dependency on global markets

- Intense competition in the EV sector

Opportunities:

- Rapid EV adoption worldwide

- Expansion in emerging markets

- Collaborations with tech companies

Threats:

- Global economic downturn

- Regulatory hurdles for emissions

- Rising raw material prices

Hyundai Motors’ Electric Vehicle Strategy and Its Influence on Share Price

-

Hyundai is aggressively expanding its electric vehicle (EV) portfolio to meet growing global demand.

-

Governments worldwide are implementing stricter emission regulations, boosting EV adoption.

-

The company invests heavily in advanced battery technology to improve EV performance and range.

-

Collaborations with technology firms enhance Hyundai’s innovation in autonomous and connected vehicles.

-

This strategic focus on EVs strengthens investor confidence and positively impacts Hyundai’s share price outlook.

-

Hyundai’s commitment to sustainability aligns with global trends, supporting long-term stock growth.

-

The EV strategy is a major factor driving Hyundai Motors’ share price target from 2025 through 2040.

Conclusion

The Hyundai Motors share price target 2025 to Hyundai Motors share price target 2040 paints a strong long-term investment picture. With consistent profit growth, evolving technology, and strategic market positioning, Hyundai Motors remains a compelling stock in the automobile sector. Keep an eye on Hyundai Motors share price target today for better short-term entry points.

Whether you’re a seasoned investor or a beginner, this is one stock to watch over the next decade.

Read Also –

- Waa Solar Share Price Target 2025 to 2050: Complete Analysis & Prediction

- Solar Industries Share Price Target 2025 to 2050: Future Predictions& Investment Guide

-

Paras Defence Share Price Target 2025 to 2050: Detailed Analysis with Year-Wise Forecast & SWOT

Solar Industries Share Price Target 2025 to 2050: Future Predictions& Investment Guide

Waa Solar Share Price Target 2025 to 2050: Complete Analysis & Prediction

Windows 11 का नया AI Feature “Click to Do”: अब स्क्रीन से ही सब कुछ करें, वो भी AI की मदद से!