RRP Semiconductor Share Price Target 2025 to 2040 – In the ever-evolving world of the stock market, few stocks have made headlines in 2025 the way RRP Semiconductor Ltd has. From being a relatively lesser-known name to delivering a 4200% return in one year, this stock has piqued the curiosity of every investor and analyst. Let’s explore a comprehensive, year-wise analysis of RRP Semiconductor Share Price Target 2025 and long-term forecasts till 2040.

Company Overview: What is RRP Semiconductor?

RRP Semiconductor Ltd is a small-cap Indian electronics company now expanding rapidly into solar technology. Recently, the company signed a major contract worth ₹439.90 crore with Telecon Infratech Pvt Ltd, Pune, for the supply of silicon solar cells and related materials.

With this move, the company is not just a semiconductor player anymore — it is now a budding clean energy contributor.

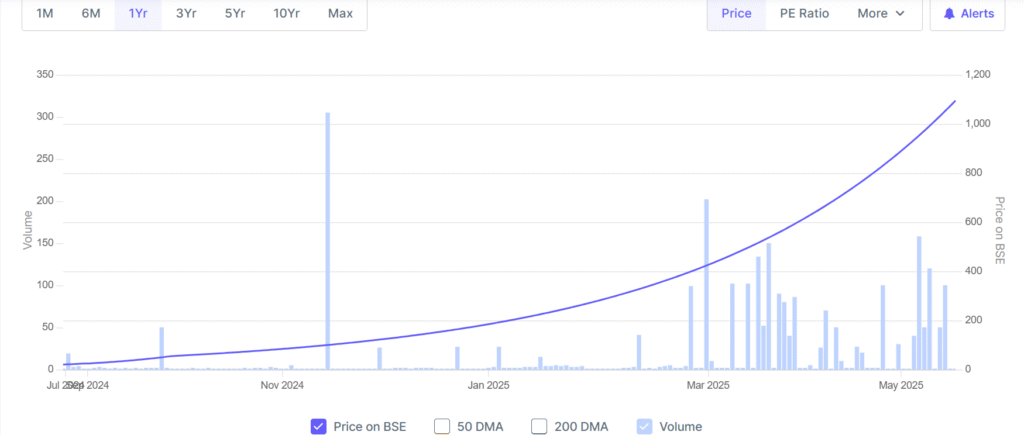

In April 2024, RRP Semiconductor was trading around ₹21. By May 2025, it soared to an all-time high of ₹899.15 per share. That’s an astonishing rise of over 4200% in just one year.

Financial Snapshot (As of May 2025)

| Metric | Value |

|---|---|

| Current Price | ₹1095.85 |

| Market Cap | ₹1,225 Crore |

| P/E Ratio | 120.85 |

| ROCE (Return on Capital Employed) | 103.5% |

| EPS (Earnings per Share) | ₹7.44 |

| Public Holding | 98.73% |

| Promoter Holding | 1.27% |

RRP Semiconductor Share Price Target 2025 to 2040 – Peer Comparison

| S.No. | Name | CMP Rs. | P/E | Mar Cap Rs.Cr. | Div Yld % | NP Qtr Rs.Cr. | Qtr Profit Var % | Sales Qtr Rs.Cr. | Qtr Sales Var % | ROCE % |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. | Adani Enterp. | 2555.00 | 64.07 | 294893.18 | 0.05 | 4014.90 | 88.79 | 26965.86 | -7.59 | 9.71 |

| 2. | Aegis Logistics | 867.55 | 52.68 | 30451.01 | 0.75 | 159.52 | -4.52 | 1706.99 | -8.88 | 14.74 |

| 3. | Redington | 280.16 | 17.89 | 21902.19 | 2.21 | 402.96 | 17.47 | 26716.08 | 13.66 | 19.46 |

| 4. | Cello World | 600.20 | 39.06 | 13257.52 | 0.25 | 92.50 | 1.80 | 556.85 | 5.65 | 36.28 |

| 5. | MMTC | 61.77 | 58.00 | 9265.50 | 0.00 | 3.66 | -93.48 | 0.25 | -65.75 | 9.23 |

| 6. | Honasa Consumer | 261.70 | 108.85 | 8510.06 | 0.00 | 26.02 | 0.46 | 517.51 | 6.00 | 16.35 |

| 7. | Lloyds Enterpris | 52.00 | 115.87 | 6615.06 | 0.19 | 24.56 | -55.03 | 489.32 | 46.63 | 6.56 |

| 8. | RRP Semiconductor | 1095.80 | 147.23 | 1492.92 | 0.00 | 6.56 | 65700.00 | 14.82 | 104.76 | |

| Median: 147 Co. | 102.02 | 28.84 | 276.88 | 0.0 | 2.33 | 6.94 | 45.73 | 16.05 | 9.72 |

RRP Semiconductor Ltd – Financial Performance (Mar 2013 – TTM 2025)

Summary of Key Financial Data (Figures in ₹ Crores)

| Year | Sales | Expenses | Operating Profit | Net Profit | EPS (₹) |

|---|---|---|---|---|---|

| Mar 2013 – Mar 2023 | ₹0 | ₹0 | ₹0 or negative | ₹0 or negative | ₹0 to -₹774 |

| Mar 2024 | ₹0 | ₹0 | ₹0 | ₹0 | -₹2 |

| TTM (Trailing 12 Months) | ₹26 | ₹16 | ₹10 | ₹10 | ₹15.39 |

Key Financial Ratios & Indicators

-

Operating Profit Margin (OPM):

-

Historically negative or zero.

-

Turned positive in TTM: 38%, a strong indicator of profitability improvement.

-

-

Net Profit:

-

The first profitable year is TTM 2025, with ₹10 crore net profit.

-

Past years show persistent losses.

-

-

EPS (Earnings per Share):

-

Historic EPS ranged from ₹0 to -₹774 — highly volatile and negative.

-

In TTM, EPS jumped to ₹15.39, reflecting strong earnings rebound.

-

-

Compounded Growth:

-

5-Year Sales Growth: 80% — indicates recent operational scaling.

-

3-Year Profit Growth: 21%

-

TTM Profit Growth: 9318% — massive leap driven by contract win or business expansion.

-

-

Stock Price CAGR:

-

1-Year CAGR: 5360%, confirming the multibagger rally.

-

RRP Semiconductor Share Price Target 2025 to 2040

While the stock has delivered extraordinary returns, analysts have a mixed opinion regarding future valuation. According to several sources, including Moneycontrol, Screener, and research-based platforms, the RRP Semiconductor share price target 2025 could vary widely based on execution and broader market conditions.

-

Minimum Target: ₹500 (if correction happens)

-

Average Target: ₹800-950 (consolidation phase)

-

Bullish Target: ₹1,200+ (if new contracts flow in)

🔍 According to RRP Semiconductor share price target 2025 Moneycontrol, the company may face valuation pressure, but continued business wins can push the stock higher.

Long-Term Share Price Forecast (2026-2040)

RRP Semiconductor Share Price Target 2026

-

If the company sustains its revenue growth from the solar sector, ₹1,300 could be a realistic target.

-

Conservative estimates point to ₹1,100, assuming slower contract executions.

RRP Semiconductor Share Price Target 2027

-

With more government push on renewable energy and electronics manufacturing, ₹1,500 is achievable.

-

Optimistic analysts forecast a possible range of ₹1,600–₹1,800.

RRP Semiconductor Share Price Target 2028

-

Continued growth, better revenue diversification, and entry into global markets could push the target to ₹2,000.

-

The company must reduce its dependency on a few contracts for sustainability.

RRP Semiconductor Share Price Target 2029

-

A strong financial track record could push the price towards ₹2,500.

-

Risks include global semiconductor competition and regulatory hurdles.

RRP Semiconductor Share Price Target 2030

The RRP Semiconductor stock forecast 2030 is widely debated. Some estimates predict:

-

₹3,000 (Base Scenario)

-

₹4,000+ (Bull Run Scenario)

This makes the stock a potential multi-decade compounder, but only if the company scales operations and maintains profitability.

🗣 Investors looking for RRP Semiconductor Share Price Target 2030 India often ask: “Will it be another multibagger?” The answer lies in how consistently the firm can deliver strong ROCE and earnings.

RRP Semiconductor Share Price Target 2040

RRP Semiconductor Share Price Target 2025 to 2040 – By 2040, if RRP Semiconductor becomes a major player in India’s clean tech and semiconductor ecosystem, the stock could reach:

-

Conservative Target: ₹5,000–₹6,000

-

Aggressive Target: ₹8,000–₹10,000+

Keep in mind, these are speculative long-term estimates, and investor discretion is advised.

RRP Semiconductor SWOT Analysis (2025 Edition)

Strengths

-

Extraordinary Stock Performance

The company delivered over 4200% return in 12 months, making it one of the top-performing stocks in 2025. -

High ROCE (Return on Capital Employed)

ROCE stands above 100%, indicating efficient capital utilization. -

Entry into Renewable Energy

A ₹439 crore contract in the solar segment shows diversification into future-oriented, high-growth sectors. -

Strong Public Interest & Liquidity

High public holding (98.73%) ensures liquidity and reflects retail investor confidence. -

Small-Cap Growth Potential

With a market cap of around ₹1,225 crore, the company has ample room to grow.

Weaknesses

-

Overvaluation Concerns

The stock trades at a P/E ratio of over 120 and a P/B ratio above 100, indicating very high valuation. -

Low Promoter Holding

Only 1.27% promoter stake raises red flags about long-term control and alignment with company goals. -

Limited Financial History

Lack of a long and stable revenue/profit record makes it hard to forecast future performance confidently. -

Single Contract Dependency

The recent surge is primarily driven by one large contract — not sustainable unless new orders continue to flow in.

Opportunities

-

Semiconductor and Clean Energy Boom

The Indian government is pushing both sectors aggressively, which could benefit RRP Semiconductor long-term. -

Make in India & PLI Schemes

If the company qualifies for government production-linked incentives (PLI), it could receive financial and infrastructural support. -

Growing Global Demand for Silicon Components

Export opportunities may rise as demand increases for semiconductor chips and solar materials. -

Retail Investor Buzz

Trending discussions on platforms like Reddit, Moneycontrol, and Telegram are creating retail momentum.

Threats

-

Market Volatility & Speculation

The massive stock rally could be followed by correction or panic selling, especially if expectations aren’t met. -

Execution Risk

If the company fails to deliver the large solar contract efficiently, reputation and future orders may be affected. -

Regulatory & Import Competition

The company may face competition from global players or regulatory hurdles in electronics and solar imports. -

Short-Term Investor Behavior

A large number of investors may exit quickly to book profits, increasing volatility.

Final Thoughts on SWOT

The RRP Semiconductor SWOT analysis reveals that while the company has significant upside potential, it carries equally serious risks, especially for short-term investors. A cautious and well-researched investment approach is highly recommended. This stock is better suited for high-risk, high-reward portfolios or investors with a strong belief in India’s semiconductor and renewable growth story.

Conclusion: Should You Buy RRP Semiconductor for the Long Term?

RRP Semiconductor has already proven itself as a high-return stock in 2025, with huge momentum. But now, it faces a crucial phase: Can it maintain that growth?

-

For short-term traders, some correction is expected due to overvaluation.

-

For long-term investors, this could be a golden opportunity — if you can handle risk and volatility.

Before investing, always refer to detailed reports, read user reviews (e.g., Reddit or Moneycontrol forums), and consult with your financial advisor.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any stock or financial instrument. The views and analysis expressed are based on publicly available data and market trends as of the time of writing. Stock markets are subject to high risks and volatility, and past performance is not indicative of future results. Readers are advised to conduct their own research and consult with a certified financial advisor before making any investment decisions. The author and the website do not assume any liability for financial losses incurred based on the content of this article.

Read More:

CLN Energy Share Price Target 2025 to 2030: Detailed Forecast & Long-Term Analysis