Ather Energy Share Price Target 2025: With the Indian electric vehicle (EV) space heating up, Ather Energy has become a strong contender in the two-wheeler EV segment. Following its IPO debut in 2025, investors and market analysts are increasingly focused on the Ather Energy share price target 2025 and beyond, assessing whether the stock can deliver long-term returns despite current volatility.

This article presents an in-depth analysis of Ather Energy’s market position, financials, growth plans, competition, and projected share price targets from 2025 to 2030.

Ather Energy IPO & Market Sentiment

Ather Energy, headquartered in Bengaluru, made headlines with its ₹2,981 crore IPO in April 2025, which included ₹2,626 crore in fresh equity. Shares listed at ₹328 — slightly above the issue price of ₹321 — but soon dipped by 5–6% on listing day, highlighting investor caution in a volatile market.

Despite the lukewarm debut, the IPO drew attention to Ather’s premium EV technology, rapid expansion plans, and growth trajectory, sparking debates around the Ather Energy share price target 2025 and what investors can expect in the next five years.

Company Overview: Ather Energy at a Glance

Founded in 2013 by Tarun Mehta and Swapnil Jain, Ather Energy is a premium EV scooter manufacturer with a growing nationwide charging network (Ather Grid). The product lineup includes the Ather 450X, 450S, and the newly launched Ather Rizta. Major backers include Hero MotoCorp, Tiger Global, and SoftBank.

Key differentiators:

-

Advanced tech: Touchscreen dashboards, OTA updates

-

Proprietary fast-charging network: Ather Grid

-

Strong presence in South India (61% of sales)

-

Focused urban distribution strategy

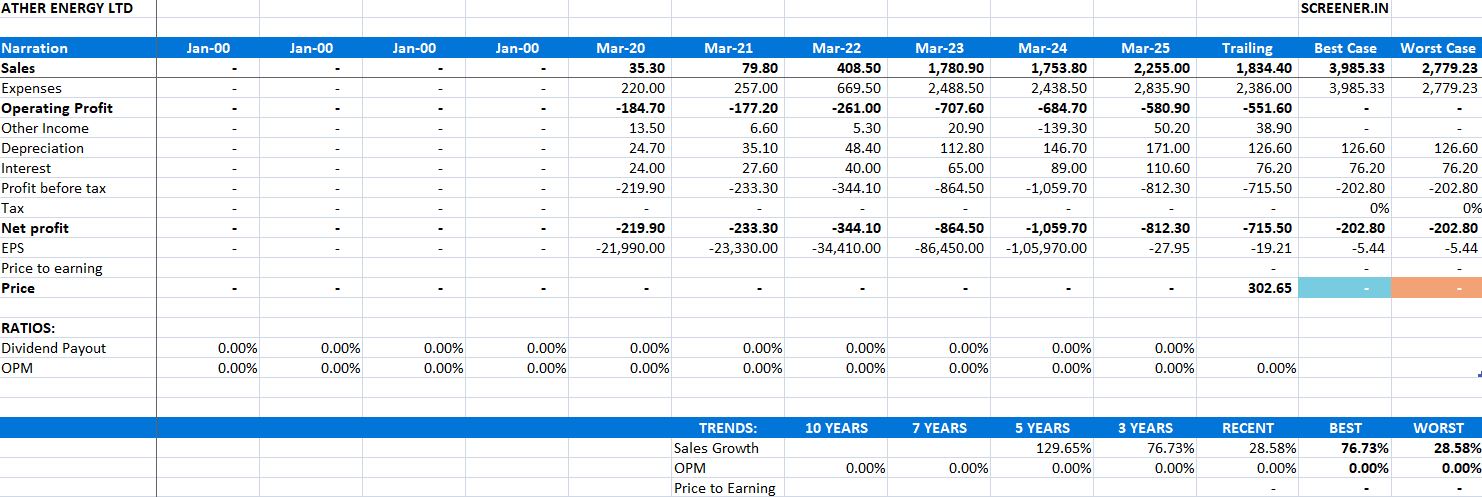

Financial Performance: FY2025 Highlights

-

Revenue: ₹676 crore in Q4 FY2025 (up 29% YoY)

-

Full-Year Revenue: ~₹1,753 crore in FY2024, slight dip from ₹1,781 crore in FY2023

-

FY2025 Net Loss: ₹812 crore (down from ₹1,059.7 crore in FY2024)

-

Scooters Sold (FY2025): 1.55 lakh units (↑ 42% YoY)

-

Gross Margins: Increased from 9% (FY2024) to 19% in FY2025

The narrowing losses and improving gross margins indicate a more sustainable business model, which could positively influence the Ather Energy share price target 2025.

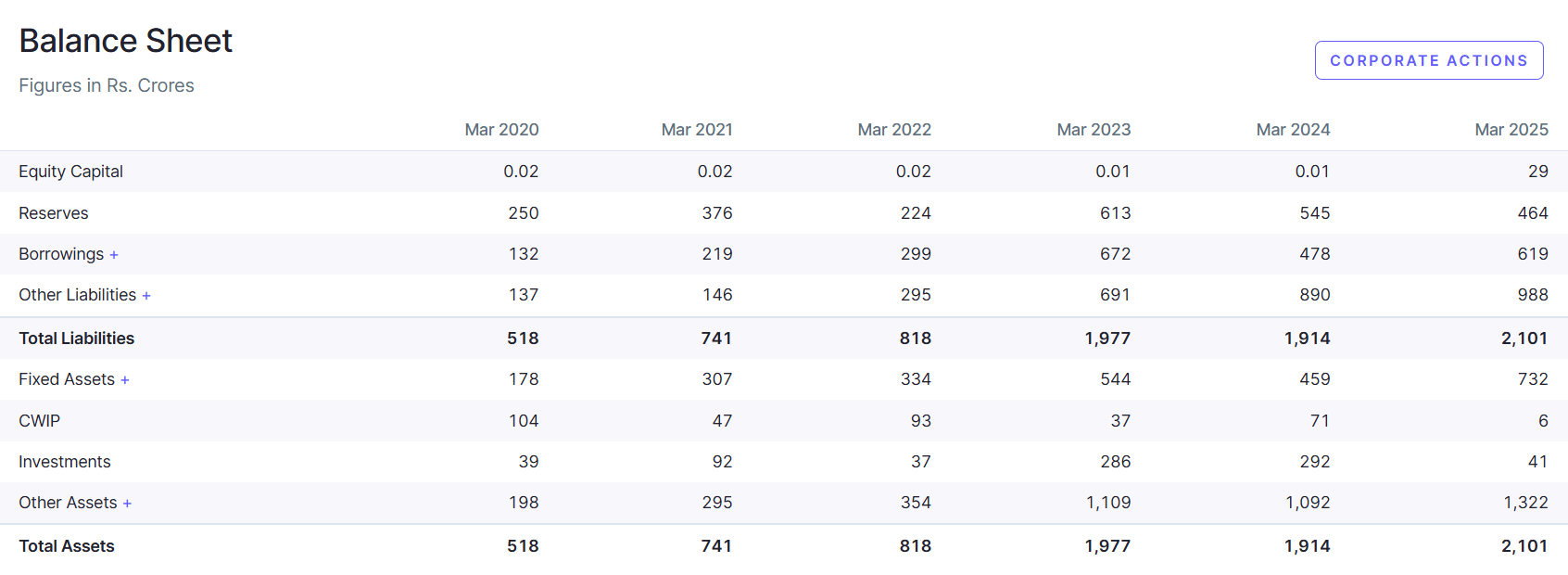

Ather Energy Balance Sheet 2024-2025

Source: Screener

Ather Energy Share Price Target (2025–2030)

| Year | Low Target (₹) | High Target (₹) |

|---|---|---|

| 2025 | ₹290 | ₹350 |

| 2026 | ₹360 | ₹430 |

| 2027 | ₹480 | ₹550 |

| 2028 | ₹600 | ₹680 |

| 2029 | ₹740 | ₹820 |

| 2030 | ₹900 | ₹1,050 |

Disclaimer: These projections are based on current trends and may vary depending on macroeconomic conditions, EV adoption, execution, and regulatory changes.

2025 Outlook: Stabilization & Recovery Phase

After a volatile IPO, Ather Energy share price target 2025 is likely to hover between ₹290–₹350, depending on Q1 and Q2 performance. Investors will watch for:

-

Expansion of Ather Grid

-

Rizta scooter sales volume

-

IPO fund deployment in R&D and capacity

-

Profit margin improvement

2026–2027: Profitability Path & Market Expansion

By 2026, Ather could break even or reduce losses significantly. A successful FY2026 would support a target price of ₹360–₹430. In 2027, with EV penetration in Tier-2/3 cities and stronger brand recall, Ather may command higher valuations with targets up to ₹550.

2028–2030: Maturity & Industry Leadership Potential

As the EV sector matures in India, Ather Energy share price targets for 2028–2030 could reflect leadership in the premium segment. If Ather delivers:

-

Consistent profitability

-

10–15% EV market share

-

Global/international expansion

…then the stock could potentially touch ₹1,000+ by 2030.

Competitor Landscape: Ola Electric, TVS, Bajaj & More

Ather’s closest rival, Ola Electric, once a market leader, has lost steam. In April 2025:

-

Ola sold 19,709 scooters

-

TVS sold 19,749 scooters

-

Bajaj sold 19,011 scooters

-

Ather sold 13,173 scooters

While Ather trails in volume, its premium appeal and technology edge set it apart. However, legacy giants like Bajaj Auto and TVS have deep financial muscle and large distribution networks. These firms are profitable, while Ather is still in the red.

Key Competitive Pressures:

-

Ola’s price-led strategy

-

TVS/Bajaj’s ICE+EV hybrid portfolio

-

Hero’s potential role in Ather’s governance

-

Rising subsidy cuts & input costs

Investor Sentiment & Analyst Views

Analysts remain divided on Ather’s near-term potential. Here’s a summary of brokerage views:

-

Geojit: Overvalued; suggested only for long-term, high-risk investors

-

Hem Securities: Called it a risky IPO due to macro instability

-

Arihant Capital: Supported for short-term gains

-

Ventura Securities: Optimistic on grid expansion and branding

Most agree that Ather Energy share price target 2025 is dependent on improved margins, subsidy clarity, and sustained growth.

Factors Influencing Ather Energy Share Price Target 2025–2030

-

EV Market Growth: Government push and rising fuel prices support adoption

-

IPO Fund Utilization: New factory, R&D, and charging infra expansion

-

Margins & Efficiency: Strong gross margin growth in FY2025

-

Competition: Ola’s stumbles are an opportunity, but legacy firms are rising

-

Brand Equity: Strong presence in southern India and loyal customer base

-

Regulatory Landscape: Policy stability on FAME subsidies will be crucial

-

Hero MotoCorp Involvement: Strategic alignment or integration could impact valuations

Final Thoughts: Is Ather a Good Long-Term Bet?

The Ather Energy share price target 2025 offers both risk and reward. The company has demonstrated strong operational growth, better margins, and a solid product pipeline. However, rich valuations and stiff competition make it a cautious buy in the short term.

By 2026–27, if Ather can transition to profitability and scale production efficiently, investors could see substantial upside. Patience, however, is key. Retail investors should monitor:

-

Q1 & Q2 FY2026 earnings

-

EV policy updates

-

Ola, TVS, Bajaj moves

FAQs: Ather Energy Share Price Prediction

Q. What is the Ather Energy share price target for 2025?

A. Analysts estimate a range of ₹290 to ₹350, depending on Q1 and Q2 earnings, EV adoption, and market sentiment.

Q. Will Ather Energy be profitable in 2025?

A. The company has narrowed its losses but may not be fully profitable in 2025. Profitability is expected between FY2026–FY2027.

Q. Is Ather a good long-term investment?

A. For high-risk, long-term investors who believe in India’s EV story, Ather offers growth potential — but it’s a volatile stock in its early stage.

If you found this analysis helpful, stay tuned to [Trendyaipost.com] for more stock forecasts and EV market insights.

🔔 Don’t forget to bookmark this page for the latest updates on Ather Energy share price target 2025 to 2030.

Disclaimer

The information provided in this article is for educational and informational purposes only. It should not be considered as investment advice or a recommendation to buy, sell, or hold any stock or financial instrument. The views and analysis expressed are based on publicly available data and market trends as of the time of writing. Stock markets are subject to high risks and volatility, and past performance is not indicative of future results. Readers are advised to conduct their own research and consult with a certified financial advisor before making any investment decisions. The author and the website do not assume any liability for financial losses incurred based on the content of this article.